My Two Cents on Financial Literacy

"The single biggest difference between financial

success and financial failure is how well you manage your money. It's simple;

to master money, you must manage money."

T. Harv Eker, Secrets of the

Millionaire Mind

You

might be wondering…

Why

do we need to manage our money?

How

do we manage our finances?

Where

to start?

Who

can we talk to about this?

I

can help you with that.

Let

me share my quick thoughts on financial literacy.

Why do we need to manage our money?

Remember

that time when you checked your payroll card or wallet and you're shooketh that

you no longer have any money? You can't even remember where or when you've used

it...

...you will be loaning from a friend, a relative or loan institution. Upon receiving

your paycheck a portion of it will go to your bills, monthly allowance for your

daily needs and wants, and to DEBTS. You

will be short of funds again and the process continues that it has been a

routine.

YOU WORK TO PAY YOUR DEBTS.

Without

effective money management, we tend to lose track of our expenses. Planning

your finances will avoid this to happen, but you need to set your priorities

first to achieve this. Just like in school you need to follow rules

and develop self-discipline.

How do we manage our money?

For

me, the best take on this is to keep track of our cashflow. Cashflow is the

movement of your money, in other words, your Income

and Expenses. We should always be mindful of the things that are coming

in and out of our pocket.

Do

not spend on something that you cannot afford or is over your income. This will

lead you to debt and interests, you will just realize that you're buried

six feet under the ground because of spending something that is way out of your

cashflow. Make a list of your wants and needs and think multiple times before

you buy something.

Where to start?

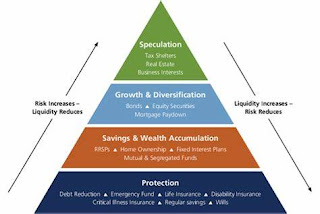

There

are a lot of institutions where you can save or invest your money. With

financial planning, we have a pyramid that you can use as a guide in starting your

journey to financial freedom.

First,

you need to build the base of your pyramid which is for PROTECTION. This will give you a good foundation in having financial

stability for those just in case moments. Start by reducing your debts. Build

your emergency fund, it's basically a savings account that you will use in dire

need. Most people start with an emergency fund worth 6 months of their monthly

expenses. Insurance is for your protection whether it be for critical illness,

disability or untimely death.

Second,

SAVINGS AND WEALTH ACCUMULATION, this is

where you will start saving and building your wealth and investments. This

phase includes buying a new home,, investing in pooled funds like UITF's and

Mutual Funds, and other low-risk investments. I highly suggest that you

continue with phase only if you have completed your foundation which is the PROTECTION.

GROWTH AND DIVERSIFICATION is an extension of

the second level of the pyramid. This is where you start building

a non-registered investment portfolio's. Investing in blue-chip companies, stock

market, bonds are some investment vehicles included in this phase.

SPECULATION is risky and we should be very cautious in investing in it. One good example is buying

multiple condominium units with minimal downpayments for the purpose of reselling

them quickly at a profit, buying gold investments, or even investing in private

partnerships. Again we should be very careful because this is a high-risk investment.

Once

accomplished in investing you will need to plan your estate as well. Many

people think it's something that only rich people do. When in fact it's simply

a process of getting your affairs in order so it will be easier for your family

members when the time comes. Estate planning is something you do for your

family. Get it done, and you'll feel better knowing that you've taken care of

them.

Who to talk to?

The

best people to talk to regarding managing your finances effectively is a

Registered Financial Planner. They are licensed and regulated, plus they take

mandatory classes and seminars on different aspects of financial planning. They

are well versed with cashflow management, financial risk management, investment

planning, estate planning, and insurance planning.

Here

are some of the famous financial planners in the Philippines.

- Randell Tiongson - http://www.randelltiongson.com

- Fitz Villafuerte - http://fitzvillafuerte.com

- Garry De Castro - http://www.financialplanningph.com

- Alvin Tabanag - http://www.pinoysmartsavers.com

- Bo Sanchez - http://bosanchez.ph

You

can also create your own financial plan, there are a lot of blogs available on

the internet that can help you start your journey to financial freedom.

Conclusion

Understanding

effective financial management can help you prepare for upcoming events in your

life, whether you will start a family, planning to buy your dream house, or even

starting your own business.

Setting

your priorities and proper mindset will help you achieve your goal for

financial stability. If you climb your financial pyramid in the specific order

and one level at a time, you will have a solid financial plan and be able to

bear up against short periods of financial hardship without jeopardizing your

long term goals.

Comments

Post a Comment